Beginner Forex Broker’s Tutorial: Exploring DeFi in Vietnam

December 29, 2024

Step-by-Step Guide: How Beginner Forex Broker Can Start with DeFi in Vietnam

For a beginner forex broker in Vietnam, the financial landscape is rapidly changing. Decentralized finance, or DeFi, is becoming a key part of this shift. It challenges traditional systems by offering peer-to-peer trading without intermediaries. As Vietnamese traders search for trusted forex alternatives, DeFi is no longer just a concept — it’s an active part of local trading life.

This tutorial walks you through simple, practical steps to start exploring DeFi in Vietnam safely.

Step 1: Know the Differences Between Forex and DeFi

Credit from CoinGeek

While forex trading involves currency pairs and brokers, DeFi platforms work directly through blockchain networks. For a beginner forex broker, this shift means less dependence on centralized systems and more direct control over trades.

Vietnam’s DeFi space offers exposure to crypto pairs instead of fiat currencies. Apps like Uniswap, PancakeSwap, and Vietnam’s growing DeFi projects make this accessible.

Step 2: Set Up a Secure Wallet

Before using DeFi platforms, you’ll need a crypto wallet. This is the first step toward participating without a traditional trusted forex broker. Popular options among Vietnamese users include MetaMask and Trust Wallet, both compatible with decentralized apps (dApps).

Be sure to back up your security phrases and never share them. Unlike regulated forex platforms, DeFi does not offer recovery options if access is lost.

Step 3: Connect to DeFi Apps in Vietnam

Once your wallet is ready, you can connect to DeFi apps Vietnam traders use. KyberSwap and other decentralized exchanges are becoming popular locally. A beginner forex broker may find these platforms surprisingly user-friendly, with simple interfaces for swapping tokens and providing liquidity.

Unlike forex brokers, these apps work automatically using smart contracts.

Step 4: Learn About Risks and Protections of Forex Broker

Credit from FasterCapital

DeFi can offer faster access and lower fees compared to some trusted forex platforms. But risks are real — smart contract failures, hacking, and price volatility are part of this space.

For beginners, it’s best to start small and avoid complex financial products until you understand how each DeFi app operates. Reading community reviews and staying updated on DeFi safety tips is part of building experience.

Step 5: Monitor Vietnam’s Crypto and DeFi Landscape

Vietnamese regulators are closely watching DeFi’s development. Policies could change quickly, which is why a beginner forex broker should stay aware of local news. The government’s stance may affect how DeFi apps operate or which assets are allowed.

For now, Vietnam’s crypto community is growing, with more local DeFi apps entering the market.

Step 6: Try Small Transactions First

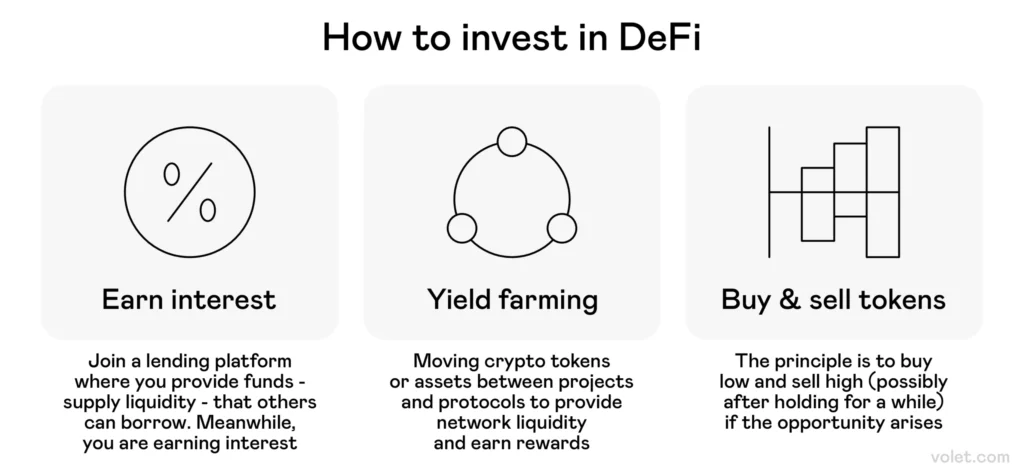

Credit from Volet.com

One of the safest ways to start is by using small amounts. Beginner traders often experiment with low-risk token swaps or stablecoins to understand how DeFi works in real life.

Even if you’re familiar with trusted forex platforms, the speed, fees, and decentralized processes in DeFi are different. Testing with small amounts allows you to learn without exposing yourself to major losses.

Conclusion: Why Beginner Forex Broker Should Consider DeFi in Vietnam

Credit from Blueberry Markets

Vietnam’s financial scene is shifting, and DeFi is opening new doors. For a beginner forex broker, this is a chance to explore beyond traditional structures and try decentralized tools that offer more freedom and flexibility. By starting slowly, focusing on trusted forex practices, and choosing secure platforms, Vietnam’s DeFi world can become an accessible next step.