BI Forex Intervention in 2025: How Bank Indonesia Navigates Rupiah Pressures in a Shifting Global Economy

May 13, 2025

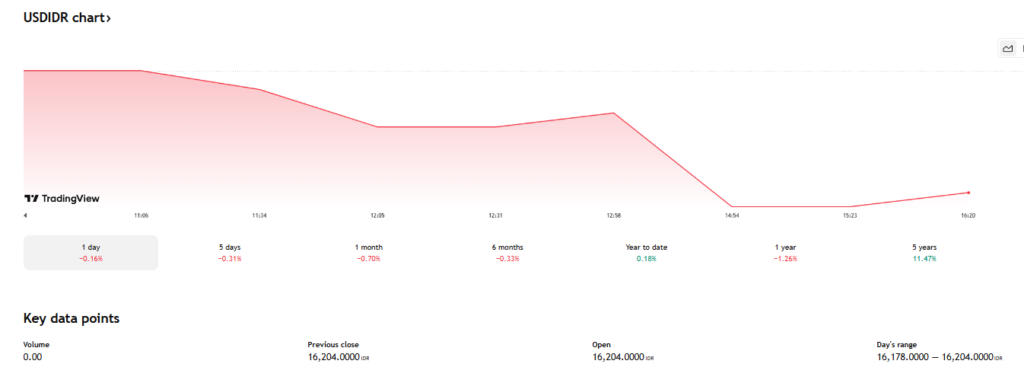

BI forex intervention : As 2025 unfolds, the global financial system continues to challenge central banks everywhere. High-for-longer interest rates, stubborn inflation in key economies, and geopolitical undercurrents have made foreign exchange markets especially sensitive. Emerging markets like Indonesia are no exception, and the rupiah has once again become a reflection of shifting capital flows and investor sentiment.

In this environment, BI forex intervention has reemerged as a critical stabilizing tool—not as a reactive defense mechanism, but as part of a broader strategy for managing Indonesia’s external vulnerabilities. So far this year, Bank Indonesia has demonstrated a consistent commitment to maintaining currency stability while allowing for reasonable flexibility. The bank’s actions show clear signs of strategic evolution.

Interventions in 2025 Are More Targeted—and More Subtle

Bank Indonesia isn’t making headlines with massive forex interventions this year. Instead, its approach has become more refined, stepping in only when needed and avoiding the kind of blanket operations that can alarm markets or burn through reserves.

In Q1 and Q2 2025, we’ve seen BI apply a mix of quiet spot market operations and carefully timed DNDF (Domestic Non-Deliverable Forward) contracts to dampen speculation. These tools provide liquidity or hedging avenues without disrupting broader market function. Compared to previous years, the tone is calmer, the moves quieter—but the intent is unmistakable: cushion volatility before it spills into inflation or business planning.

BI forex intervention: BI’s Reserve Position Remains Strong—And That Matters

Source: TradingView

One of the reasons BI can afford a more confident approach is its robust reserve position. As of mid-2025, foreign exchange reserves remain well above USD 130 billion, offering a reliable buffer without raising concerns about depletion. This allows the bank to act when necessary without signaling panic or policy desperation.

In this context, intervention isn’t about defense—it’s about guidance. BI is using reserves as a stabilizing presence, not a daily tool. This signals to markets that the bank has room to maneuver and won’t need to overcorrect under pressure.

DNDFs Gain Momentum as the Preferred Tool in 2025

The growing use of Domestic Non-Deliverable Forwards (DNDFs) has been one of the most notable developments in 2025. These instruments give banks and corporations a way to hedge future exchange rate exposure without requiring actual USD delivery. For Bank Indonesia, DNDFs offer a way to shape future expectations while preserving reserve liquidity.

This year, DNDF auctions have become more regular, and market uptake has been strong. BI’s use of DNDFs also reflects a shift toward more market-driven, less interventionist policy frameworks—offering tools instead of controls.

Market Confidence Remains Intact

Source: TradingEconomics

So far, financial markets have responded positively to BI’s approach. The rupiah has experienced fluctuations, but within a contained range. The absence of dramatic price swings or speculative pressure suggests that market participants believe BI will step in when necessary—and only then.

That credibility matters. In 2025, trust in central bank consistency is a currency of its own. And BI’s recent performance shows that trust is being maintained, even as regional peers face sharper depreciation risks.

Fiscal and Monetary Coordination Is Key to Intervention Success

Source: Global Business Outlook

Behind every successful currency stabilization effort is a bigger picture. In 2025, BI isn’t working in isolation. The central bank’s actions have been coordinated with Indonesia’s fiscal authorities, ensuring that interventions aren’t undermined by contradictory spending or external account weaknesses.

This coherence reinforces the credibility of each intervention. Whether through statements on inflation targeting or joint economic briefings, BI is making it clear that intervention isn’t a standalone effort—it’s part of a larger stability strategy.

What Lies Ahead for BI Forex Intervention in the Second Half of 2025?

Looking forward, much depends on global sentiment. Will the U.S. Federal Reserve ease policy by year-end? Will China’s demand recover? Will commodity prices rebound? Each of these factors could either ease or increase pressure on the rupiah.

What’s clear is that BI forex intervention in 2025 is likely to remain selective, cautious, and increasingly sophisticated. Spot interventions may still occur, but DNDFs, swap arrangements, and macroprudential signals will continue to dominate the strategy. This is no longer just about defending a number—it’s about defending economic momentum.

Conclusion: BI Forex Intervention 2025 Signals a More Modern, Measured Currency Policy

As we reach the mid-point of a complex economic year, BI forex intervention in 2025 reveals a shift in style: from reactive defense to preemptive calibration. Bank Indonesia has shown that currency stability doesn’t have to come from force—it can come from confidence, clarity, and calculated precision.

By focusing on timing, communication, and structural tools, BI has positioned itself not just as a market actor, but as a steward of financial resilience. In today’s economy, that kind of intervention is less about control—and more about building trust.