Supported Coins on Crypto Cards: A Technical Breakdown of Compatibility

December 3, 2024

Understanding Crypto Card Infrastructure and Coin Support Logic

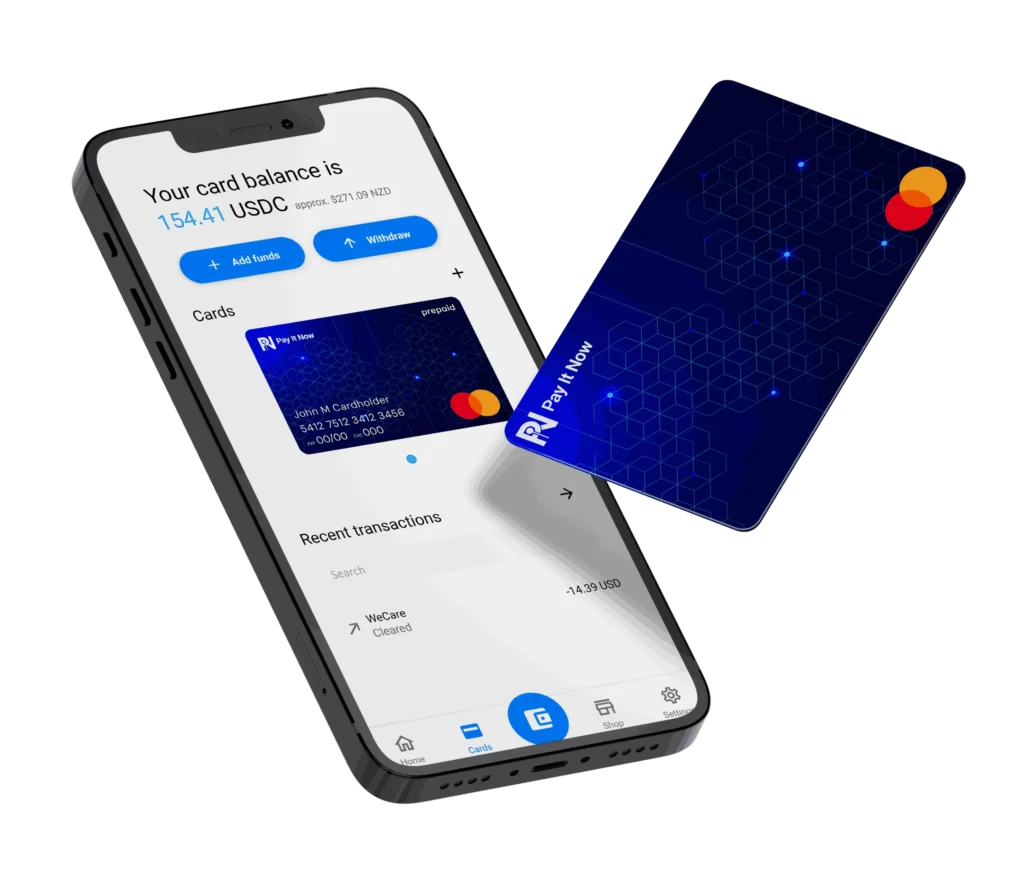

Crypto card coins: Crypto cards serve as a bridge between blockchain assets and traditional payment systems. These cards operate by converting cryptocurrency holdings into fiat at the point of sale, usually through APIs integrated with Visa or Mastercard networks.

A central question for users is: Which crypto assets are supported by these cards, and how does that support function under the hood? This technical breakdown addresses that, with a focus on coin categories, wallet-to-card mechanics, and conversion protocols.

Crypto Card Coins : High-Cap Adoption Coins

Crypto card issuers typically prioritize coins with:

- High liquidity

- Large user base

- Regulatory clarity

- Fast transaction finality

Thus, the majority of cards offer native or auto-conversion support for:

- Bitcoin (BTC) – Direct wallet support; almost universally integrated.

- Ethereum (ETH) – Commonly supported, though conversion fees apply due to gas variability.

- Litecoin (LTC) – Preferred for speed and low fees.

- Bitcoin Cash (BCH) – Included due to fast transaction processing and broad legacy support.

These coins function as the default rails on which many card platforms build their asset conversion stack.

Secondary Assets: Altcoin Enablement by Exchange-Linked Cards

Exchange-integrated cards (e.g., Binance, Crypto.com) allow expanded compatibility via internal exchange mechanisms. These platforms enable dynamic conversion of various altcoins to fiat at the time of transaction.

Supported altcoins often include:

- Cardano (ADA)

- Solana (SOL)

- Polkadot (DOT)

- Polygon (MATIC)

- Avalanche (AVAX)

Technical Note:

In most cases, these coins are not directly used at the point of sale. Instead, the backend system executes a real-time conversion to a fiat counterpart (USD, EUR, etc.), using the user’s coin balance as the source.

Stablecoin Integration: Predictable Conversion Logic

Stablecoins are highly preferred in crypto card ecosystems for their price stability and low volatility risk. Their 1:1 pegging to fiat currencies allows issuers to minimize risk and streamline accounting.

Commonly supported stablecoins:

- USD Coin (USDC) – Often used as a default load currency due to compliance track record.

- Tether (USDT) – Widely accepted despite ongoing scrutiny.

- Binance USD (BUSD) – Supported primarily by Binance-linked products.

Conversion is typically instantaneous with minimal slippage, offering a more frictionless user experience compared to volatile tokens.

Tertiary Tokens: DeFi and Meme Asset Handling

Cards may also support niche assets, including governance tokens and community-driven coins. However, their availability is inconsistent and often contingent upon:

- Exchange listings

- Market liquidity

- Legal/regional compliance

Examples of conditionally supported tokens:

- Uniswap (UNI)

- Chainlink (LINK)

- Aave (AAVE)

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

Processing Behavior:

These tokens are often converted automatically during payment, unless specifically whitelisted for direct debit.

Comparison Table: Supported Coin Categories by Provider

| Provider | BTC/ETH | Altcoins | Stablecoins | Meme/DeFi Tokens |

|---|---|---|---|---|

| Crypto.com | Native | Broad | USDT, USDC | DOGE, SHIB, LINK |

| Binance Card | Native | Extensive | BUSD | Multiple |

| Coinbase Card | Native | Limited | USDC | Few |

| BitPay Card | Native | Moderate | USDC, USDT | Some |

Behind the Scenes: How Crypto Cards Process Coins

Crypto cards rarely spend crypto directly. Here’s how the backend works:

- User loads the card wallet with supported crypto (e.g., ETH).

- At the time of purchase, the card processor converts the crypto into fiat using real-time exchange rates.

- The transaction is settled in fiat with the merchant via traditional card networks.

This model simplifies vendor interactions while preserving crypto utility for users.

Fee Structures and Hidden Costs

From a technical perspective, fees stem from:

- Network fees – Blockchain transaction costs (e.g., Ethereum gas)

- Spread margin – The exchange rate difference between market and conversion

- Card-specific fees – Issuance, loading, or foreign exchange charges

Most platforms disclose this in their documentation, but fee automation is tied to wallet activity and token volatility.

Final Evaluation: Matching Card Functionality to Asset Usage

In evaluating crypto card coins, users should consider:

- Conversion mechanisms (manual vs. automatic)

- Fiat settlement speed

- Coin-specific restrictions

- Backend processor capabilities

In summary, while most cards support a core group of major coins, deeper functionality relies on exchange relationships, user geography, and real-time liquidity access.

Relevent news: Here