Day Trading vs Swing Trading in Indonesia: Choosing the Right Strategy in 2025

March 7, 2025

Day Trading Indonesia has gained remarkable popularity among Indonesian retail traders thanks to the increasing availability of online platforms and lower entry barriers. This strategy focuses on opening and closing positions within the same day, often in minutes or hours, to capture small price movements. The appeal lies in its quick turnaround — traders don’t hold positions overnight, which reduces exposure to after-hours market news. In Indonesia’s active forex and crypto communities, many day traders thrive on high volatility, news-driven movements, and technical setups. However, this approach demands a high degree of focus, risk control, and the ability to make fast decisions under pressure.

Swing Trading: Day Trading Indonesia- Flexibility and Technical Depth for Indonesian Traders

Swing trading is an excellent choice for Indonesian traders who prefer a more structured and less time-sensitive approach. Instead of reacting to rapid price changes, swing traders hold positions for days or even weeks, aiming to benefit from broader market trends. This method is ideal for individuals with full-time jobs or academic schedules, as it allows more time for technical analysis and planning. The use of indicators like MACD, RSI, and trendlines plays a key role, and traders typically make decisions after market hours or during less volatile periods. In the Indonesian context, swing trading offers a balanced path between commitment and control.

Day Trading Indonesia: Matching Your Schedule to Your Strategy

One major deciding factor between day trading and swing trading is time availability. Indonesian traders with flexible schedules or full-time dedication to markets may find day trading more suitable, as it requires constant monitoring during market hours. On the other hand, swing trading accommodates those who only have limited windows each day for analysis and execution. Many part-time traders in Indonesia rely on swing strategies to balance trading with work, family, or studies. In either case, aligning your trading style with your lifestyle can lead to better consistency and reduced stress.

Day Trading Indonesia: Emotional Discipline in Day vs Swing Trading

Source: iStock

Day trading is not just about speed — it’s also emotionally demanding. Making multiple decisions in rapid succession can cause fatigue, especially after losses. Indonesian traders need to prepare for intense highs and lows throughout a single session. By contrast, swing trading offers a slower pace and fewer emotional triggers. Trades are planned in advance, allowing more control and less emotional reactivity. For beginners or those who prefer a calm mindset, swing trading may be easier to sustain emotionally in the long run. Developing self-awareness and discipline is essential, whichever path you take.

Profit Potential and Risk Management

Both styles offer profitable opportunities, but the mechanics differ. Day trading targets smaller gains with frequent trades, relying heavily on timing and volume. It can deliver rapid profits but also quick losses if risk isn’t managed well. Swing trading aims for fewer but larger moves, giving trades more room to develop. For Indonesian traders, the choice depends on how you prefer to manage risk — tighter stop losses and faster exits for day trading, or broader stop losses and longer holding periods for swing trading. The key is consistency, not frequency.

Popular Markets and Instruments in Indonesia

Source: Dreamstime

In 2025, Indonesian traders engage with a wider variety of markets than ever before. Day traders often gravitate toward forex majors, commodities like XAU/USD, and fast-moving crypto assets. These instruments offer volatility and liquidity — perfect for quick trades. Swing traders, meanwhile, are more likely to analyze economic cycles, central bank policies, and weekly chart patterns across indices and currencies. With better access to platforms and analytical tools, traders across both styles are finding it easier to access global markets from Indonesia.

Personality and Strategic Fit

Source: depositphotos

The effectiveness of any trading style depends not just on market conditions, but also on the trader’s personality. If you are energized by action, enjoy problem-solving under pressure, and are comfortable with risk, day trading might be your calling. But if you prefer deep analysis, patience, and structured planning, swing trading will likely align better with your temperament. In Indonesia’s diverse trader base, personal fit often matters more than strategy itself. Self-awareness can be just as important as technical skill when it comes to long-term success.

Exploring Both Styles as a New Trader

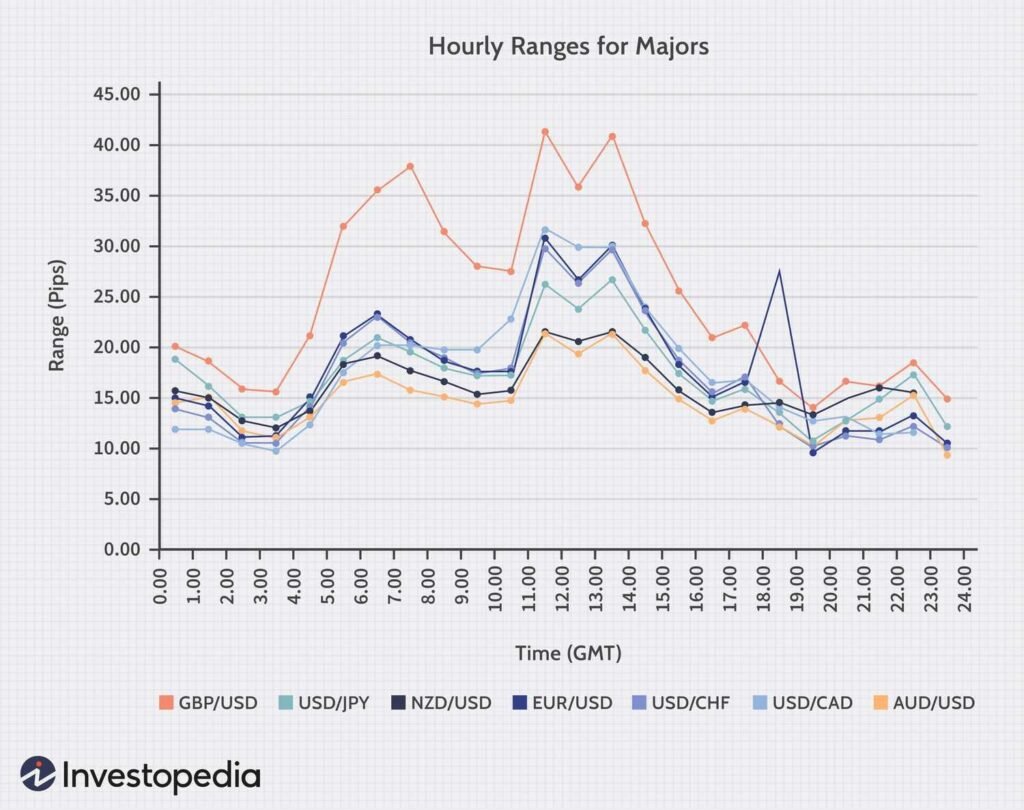

Source: Investopedia

Many traders in Indonesia start by experimenting with both methods. Demo accounts and micro-lot trading offer a chance to test how you react to different market rhythms. Some traders find a hybrid approach useful — day trading during high-volatility sessions and swing trading during quieter periods. What matters is developing a trading routine that aligns with your goals, capacity, and mindset. The flexibility of Indonesia’s trading ecosystem in 2025 means you can evolve your strategy over time without pressure to stick to a single style.

Final Thoughts: Finding the Right Trading Identity

The real question is not whether day trading or swing trading is objectively better, but which one matches your lifestyle, psychology, and goals. Indonesia’s trading community is maturing, and traders have access to more education, brokers, and tools than ever before. Whether you’re seeking fast-paced excitement or a methodical, strategic flow, the answer lies in experimentation, reflection, and adaptation. In 2025, Indonesian traders are not boxed into one strategy — they’re empowered to find what works best for them, and to grow with the markets.