ETH vs BTC: Tracking Crypto Trends Shaping Vietnam’s Digital Future

April 29, 2025

The ETH vs BTC debate has entered a new phase — especially in Southeast Asia, where Vietnam’s growing presence in the crypto market is attracting international attention. While both Ethereum and Bitcoin remain foundational assets, distinct local trends suggest Ethereum growth is quietly gaining ground.

Vietnam’s high internet penetration, tech-savvy youth, and rapid mobile payment adoption make it an ideal testing ground for decentralized innovations. Within this climate, comparing Bitcoin vs Ethereum in Vietnam offers more than just a price-to-performance view; it’s about cultural fit, infrastructure readiness, and regulatory curiosity.

ETH vs BTC Vietnam: Breaking Down Investor Behavior

Credit from Bitcoin.com News

Bitcoin retains dominance as a recognized digital store of value. In Vietnamese circles, especially among more risk-averse or older investors, BTC is still perceived as the “safer” option — largely due to its longer track record and capped supply.

But younger investors, particularly those engaged in local Web3 communities and DeFi platforms, are showing a clear tilt toward Ethereum. According to several blockchain community meetups in Ho Chi Minh City and Hanoi, participants expressed stronger interest in Ethereum’s development capabilities — from NFTs to DAO governance models.

This divergence underpins a broader trend: Ethereum is being evaluated not just as an asset, but as a digital ecosystem. And in Vietnam, that matters.

Ethereum Growth VN: A Platform for Builders

Credit from CoinLaw

Vietnam’s startup scene is already leveraging blockchain technologies. Local developers are building on the Ethereum Virtual Machine (EVM), deploying smart contracts for everything from education tokens to real estate solutions.

What sets Ethereum apart in this context is flexibility. Unlike Bitcoin, Ethereum supports real-world applications. From a trend perspective, this positions Ethereum investment in Vietnam not only as a financial bet, but also as strategic participation in digital infrastructure.

Events such as Vietnam Blockchain Week and the rise of local Ethereum developer communities add to the momentum. And as discussions around central bank digital currencies (CBDCs) continue, Ethereum’s architecture could serve as a potential template for public-private digital frameworks.

Regulatory Signals and the Crypto Market Vietnam

Credit from Coin Edition

Vietnam’s stance on crypto remains cautious yet open. There is no full legalization — but also no ban. Instead, the government seems to be observing and collecting data.

This uncertainty has a subtle impact on the ETH vs BTC dynamic. While Bitcoin appeals to those seeking hedge assets amid regulatory fog, Ethereum’s use cases — especially for digital identity, logistics, and tokenized services — are drawing attention from startups that expect regulation to eventually legitimize selected crypto functions.

Analysts monitoring Ethereum growth potential in Vietnam often point to parallel sectors such as fintech and mobile commerce. If those continue to mature alongside clearer regulatory frameworks, Ethereum’s role could solidify beyond speculation.

Comparing ETH vs BTC for Vietnam Traders: A Dual Narrative

Credit from Ken Research

The typical Vietnamese crypto investor today is no longer just a trader but often a participant in broader crypto ecosystems — staking, yield farming, contributing to DAOs, or experimenting with NFTs.

In that landscape, comparing Bitcoin and Ethereum for Vietnam traders reveals a split: BTC as digital gold; ETH as digital infrastructure.

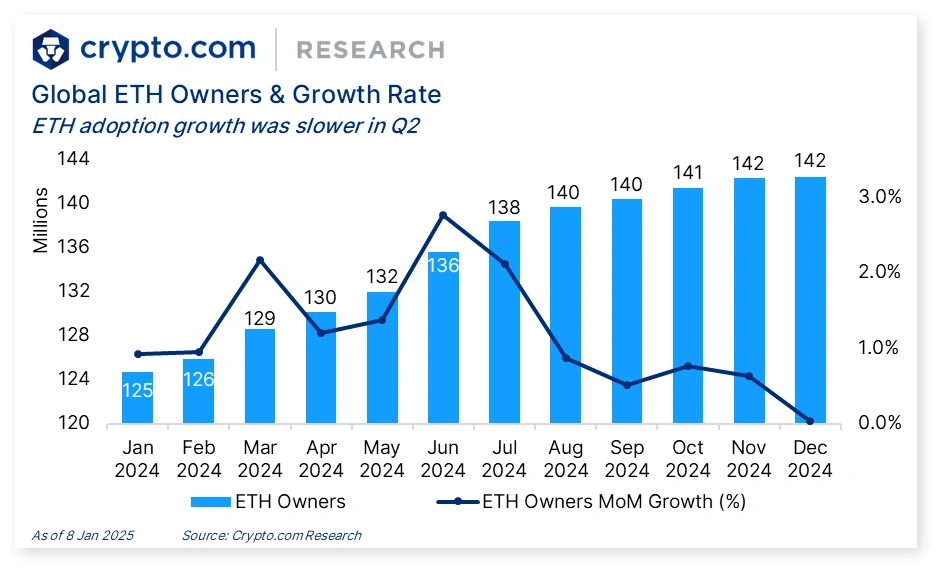

Market trend data shows that trading volumes still lean slightly toward BTC during global volatility, but the long-term wallet holding patterns (especially on local exchanges) suggest growing faith in Ethereum as a productive asset.

Conclusion: Ethereum Growth in Vietnam Could Outpace Expectations

Credit from Ken Research

The ETH vs BTC conversation is far from settled. However, Vietnam’s rapidly evolving digital environment may prove to be a catalyst for Ethereum growth. From on-the-ground development projects to shifting investor sentiment, signs point to Ethereum becoming more than just a speculative asset in the region.

That doesn’t diminish Bitcoin’s relevance — especially during global economic uncertainty — but for investors in Vietnam looking toward utility, innovation, and integration with local digital trends, Ethereum’s trajectory is increasingly compelling.

As the crypto market in Vietnam continues to evolve, the ETH vs BTC debate may ultimately reflect a broader shift: from digital currency to digital infrastructure, and from passive investment to active participation.