Ethereum vs Bitcoin Singapore: What’s Fueling Ethereum’s Rise in 2025

March 9, 2025

In Singapore, the crypto conversation has evolved steadily over the past few years. While it once centered on price swings or name recognition, it has now shifted—more decisively—toward real-world use, regulatory alignment, and sustainable development. By 2025, it’s increasingly evident that Ethereum is gaining momentum in ways that Bitcoin is not. In fact, in the ongoing comparison of Ethereum vs Bitcoin Singapore, Ethereum’s advantage lies in its adaptability and its fit with Singapore’s progressive, policy-driven approach to blockchain adoption.

Ethereum vs Bitcoin Singapore – A Matter of Policy Fit

Singapore’s Monetary Authority isn’t taking a passive role. In fact, through initiatives like MAS Project Guardian, the government has been actively running pilots that test tokenization, DeFi, and programmable money—all on Ethereum. Not only does this show strategic intent, but it also highlights Ethereum’s unique advantage. Thanks to its flexibility with smart contracts, Ethereum provides a more adaptable foundation for testing regulatory frameworks compared to other blockchains.

Bitcoin, while secure and trusted as a store of value, simply doesn’t offer the same level of programmability. Its rigidity, once considered a strength, now makes it less compatible with Singapore’s experimental and policy-aligned direction.

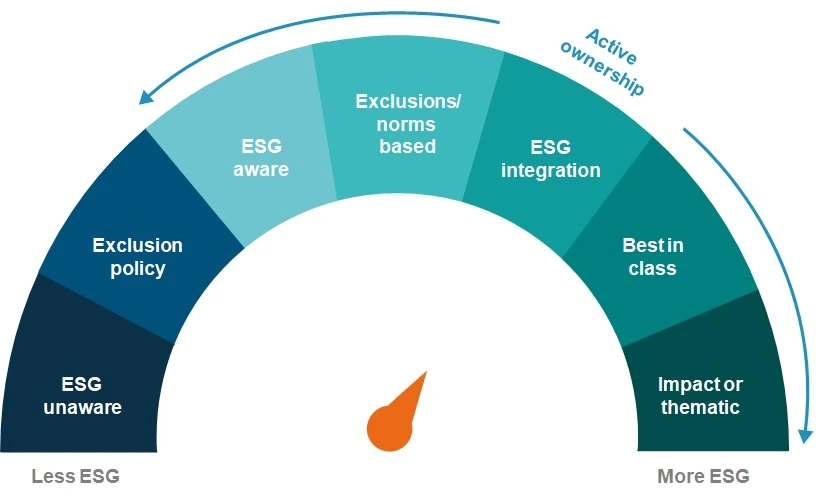

The Ethereum Merge Impact: ESG Investing Comes Into Focus

Created By fidelity

Singaporean institutions are under growing pressure to meet sustainability benchmarks. Since the Ethereum Merge impact in 2022, the chain’s energy usage has dropped by over 99%. For ESG crypto investing, this isn’t a minor perk—it’s a prerequisite.

Meanwhile, Bitcoin’s proof-of-work model still raises concerns over environmental impact. Until mining practices catch up with ESG demands, Ethereum holds a more favorable position in regulated financial environments.

Real Adoption: Ethereum Smart Contracts in Singapore

Created By singaporelegaladvice

Ethereum has moved well beyond theory in Singapore. Companies are actively using it in practical ways—for example, in property tokenization and carbon credit tracking. Ethereum smart contracts Singapore now support real-world business models directly. In addition, legal tech pilots, real estate compliance efforts, and DeFi platforms rely on Ethereum’s smart contract functions to streamline workflows and apply rules automatically. This shift highlights not just innovation, but actual usage growing on the ground.

This goes beyond what Bitcoin can offer. While Bitcoin’s Layer 2 solutions are being developed, they haven’t reached the same scale or adoption level in Singapore.

Tokenization in Singapore – Why Ethereum Leads

Created By forkast

Tokenization is no longer a buzzword. In 2025, it’s a serious part of Singapore’s financial innovation push. Whether it’s digital bonds, fractionalized real estate, or tokenized carbon assets, Ethereum-based standards like ERC-1400 are quietly becoming the norm.

Tokenization in Singapore is, in essence, a story about infrastructure—and Ethereum is the backbone. Bitcoin’s limitations require third-party bridges or sidechains, which institutions are often less willing to adopt.

Crypto Adoption Singapore – Following the Developers

Created By fintechnews

Adoption tells the clearest story. Head to any blockchain accelerator in Singapore, and you’ll see most developers working on Ethereum-compatible tools. From fintech startups to compliance sandboxes, the infrastructure that’s being built—and funded—is largely Ethereum-first.

That doesn’t mean Bitcoin is obsolete. It still dominates long-term value storage. But in Ethereum vs Bitcoin Singapore, Ethereum is becoming the development platform of choice.

Conclusion: Ethereum vs Bitcoin Singapore in 2025 – A Structural Shift

Created By cash2bitcoin

Ethereum’s rise in Singapore isn’t just about hype—it shows how institutions and startups are actively adopting its ecosystem. The network fits smoothly into local rules, supports ESG goals better than its peers, and powers tokenization pilots that are moving from testing to real application. For example, real estate trials and compliance-focused smart contracts are already running. So rather than staying theoretical, Ethereum is becoming part of Singapore’s financial infrastructure, one step at a time.

Bitcoin still earns respect as digital gold. But developers and policymakers in Singapore are building with Ethereum, integrating it into pilot programs, and testing it against regulatory standards. That’s why Singapore’s blockchain future seems increasingly tilted toward Ethereum.