Gold Hedge Rupiah: How Holding Only IDR Could Be Quietly Costing You

June 5, 2025

Gold hedge rupiah: If the last few years have taught us anything, it’s this: economic stability is not a guarantee — especially when it comes to currencies like the Indonesian rupiah.

Despite temporary rebounds, the rupiah has been gradually weakening against the US dollar. And if you’re holding all your savings in IDR, you might be losing more than you think. A gold hedge rupiah strategy is no longer just “nice to have” — it’s increasingly a financial necessity.

Here’s what you need to know now — before the next slide hits.

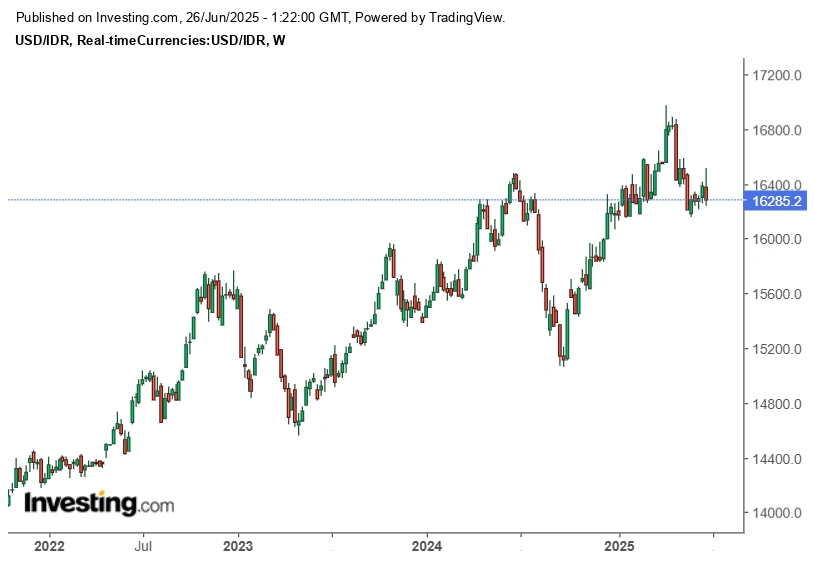

Risk #1: The Rupiah’s Long-Term Trend Isn’t Pretty

Source: Investing.com

Yes, there are good months, and sometimes even stronger quarters. But if you zoom out and look at the last 5–10 years, the overall picture of the rupiah against the US dollar shows consistent weakness.

Every time the rupiah drops, anything priced in USD — including imported goods and gold — becomes more expensive in IDR. That means the real value of your savings shrinks. Unless you’ve hedged.

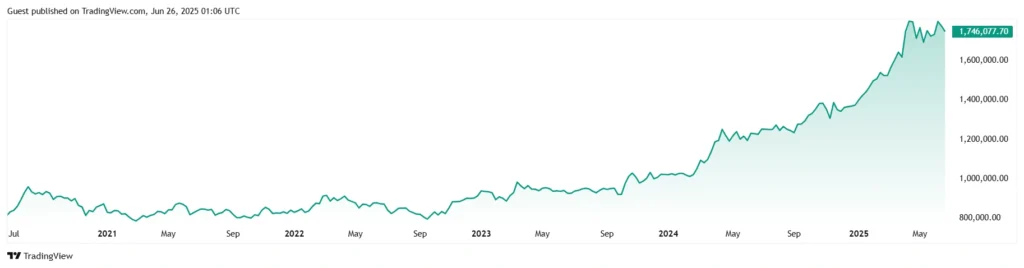

Risk #2: Inflation and Currency Drop — a Double Hit

Source: TradingView

It’s bad enough when prices go up. But it’s worse when your money is simultaneously worth less. Inflation has already pushed up the cost of fuel, food, and services. Add currency devaluation to that mix, and your money is under real pressure.

Gold, on the other hand, tends to hold its value — or even rise — when currencies fall. That’s why many Indonesians are using a gold hedge rupiah tactic to shield part of their savings.

Risk #3: Gold hedge rupiah- Gold Becomes Harder to Afford the Longer You Wait

Here’s the tricky part — gold prices in IDR tend to rise before the average person reacts. Once news hits that the rupiah is dropping, demand for gold spikes and local prices jump. At that point, you’re buying in after the move — not hedging, but chasing.

By acting earlier, even in small amounts, you avoid overpaying and start building real protection.

Gold hedge rupiah: Why Gold Still Makes Sense in 2025

Gold isn’t perfect — it doesn’t pay interest or dividends — but its track record during crisis periods speaks for itself. It’s liquid, globally accepted, and stable when currencies are volatile.

More importantly, you don’t need to be rich or buy physical bars to get started. Thanks to digital platforms, even small savers in Indonesia can begin hedging with 0.1g of gold.

How Indonesians Are Building a Gold Hedge

Here are some of the practical options people are turning to:

- Digital gold apps like Pluang, Lakuemas, and Tokopedia Emas allow you to buy and sell instantly

- Physical gold from Antam or Pegadaian — ideal if you want to hold it yourself

- Gold ETFs or funds — useful if you already use investment platforms

Whichever route you take, the key is to move before the crowd.

Final Risk: Believing Things Will Always Return to Normal

Some believe the rupiah will “bounce back soon” or that inflation will “cool down eventually.” And maybe that’s true. But even if that happens, there’s no harm in being prepared.

What’s more likely? More volatility, more external shocks, and more unpredictability. In that case, the cost of not hedging with gold could be far greater than you expect.

Closing Thoughts

You don’t need to go all in on gold — even setting aside 10% of your savings can make a difference. But waiting too long leaves you exposed to a weakening currency and rising costs.

A gold hedge rupiah plan is not a luxury. It’s a step toward financial resilience. And in today’s climate, that’s something you can’t afford to delay.