MACD RSI for Forex Indonesia: Optimizing Momentum Strategy in the 2025 Trading Landscape

January 31, 2025

MACD RSI for Forex Indonesia: As the forex market in Indonesia becomes increasingly fast-paced in 2025, momentum-based strategies are emerging as essential. Traders are reacting to fluctuating global commodity prices, U.S. interest rate speculation, and regional political shifts by adopting more technical tools. Among these, the combined use of MACD RSI for Forex Indonesia has gained widespread appeal for its ability to deliver insights into both price direction and trend strength. This dual-indicator approach is giving Indonesian traders the edge they need to navigate the daily waves of volatility.

What MACD Brings to the Table: Tracking the Heartbeat of Trends

MACD, or Moving Average Convergence Divergence, has stood the test of time due to its simple structure and clear signals. In Indonesia’s 2025 forex scene, it is favored for helping traders stay on the right side of the trend. When the MACD line crosses above its signal line, it often reflects rising momentum — a useful sign when trading IDR pairs like USD/IDR or AUD/IDR. With market trends often shifting on global cues, MACD enables Indonesian traders to catch early trend movements or avoid entering positions too late in the cycle.

RSI: MACD RSI for Forex Indonesia- Sensing the Strength of Price Pressure

Source: schwab

While MACD helps track trends, the Relative Strength Index (RSI) measures how intensely buyers or sellers are pushing the market. RSI is often seen as the emotional pulse of the forex chart. Indonesian traders in 2025 are using RSI more tactically — not just to identify overbought or oversold zones, but to confirm the conviction behind price movements. For example, a rising RSI alongside a bullish MACD crossover suggests genuine buyer momentum. On the other hand, a bearish divergence — when price makes new highs but RSI does not — often signals a weakening trend.

Combining MACD and RSI: MACD RSI for Forex Indonesia- A Trusted Strategy Among 2025 Indonesian Traders

By themselves, MACD and RSI provide valuable insights — but together, they offer a more robust trading strategy. In Indonesia, many 2025 traders adopt a multi-indicator confirmation method, where they wait for a MACD crossover to indicate potential trend direction and use RSI to assess the reliability of that signal. This dual setup is particularly useful during consolidation phases, helping traders distinguish between genuine breakouts and false alarms. The synergy of MACD RSI for Forex Indonesia has become a go-to framework for identifying trades with stronger probability.

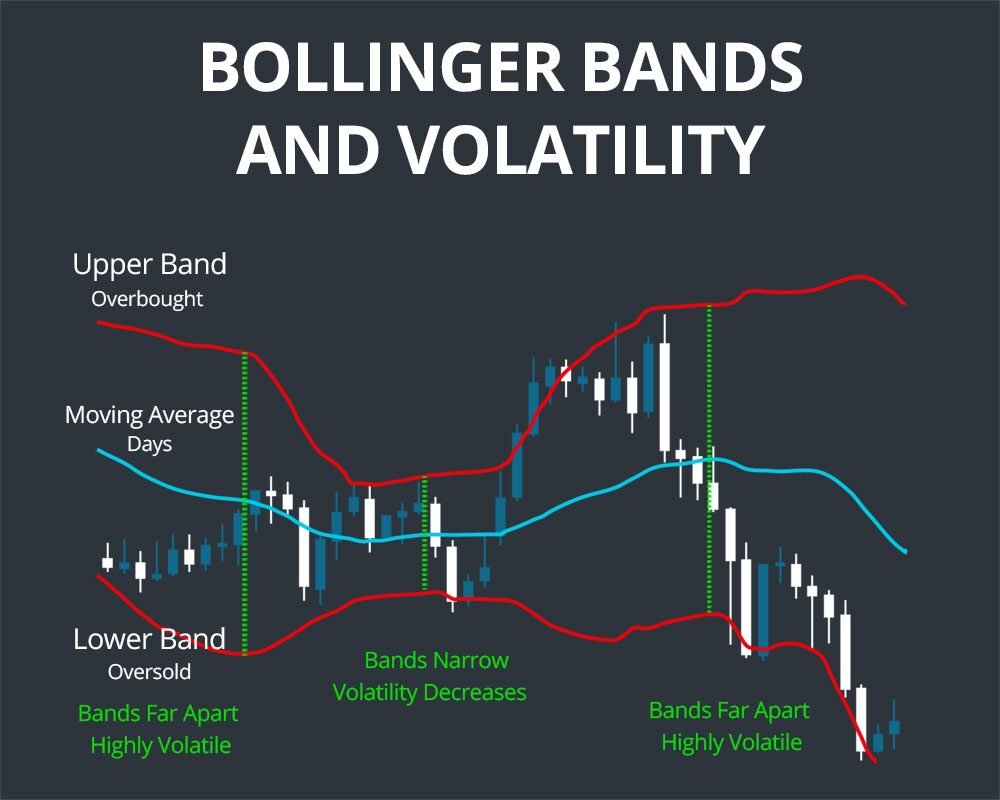

Why Bollinger Bands Add Extra Context to Momentum Trades

Source: Scanz

Volatility is an ever-present feature of the Indonesian forex market, especially during central bank announcements or global energy price swings. To manage this, traders often layer Bollinger Bands with MACD and RSI. Bollinger Bands highlight potential volatility spikes and price extremes. In 2025, an increasingly common setup among Indonesian traders is spotting a Bollinger Band breakout while MACD and RSI both point in the same direction. This alignment gives greater confidence that the breakout is backed by momentum — not just noise.

Trend Confirmation with Moving Averages

Source: okx

To add an extra layer of confirmation, many Indonesian traders include a short- to mid-term moving average like the 20- or 50-day EMA. This helps ensure that MACD and RSI signals are in harmony with the broader trend. If the price is above the 50 EMA, and both MACD and RSI show bullish signals, the probability of a successful trade increases. In 2025, this kind of layered strategy is allowing traders to avoid false breakouts and time their entries and exits more effectively in a noisy and rapidly changing market.

Precision Entry with Stochastic Oscillator

Traders looking to sharpen their entries often incorporate the stochastic oscillator into their MACD-RSI framework. The stochastic helps to fine-tune timing, especially in sideways markets. For Indonesian traders in 2025, a common practice is waiting for a bullish stochastic crossover in oversold territory while MACD starts diverging positively and RSI climbs toward the 50–60 range. This three-point confirmation gives traders higher conviction in short-term entries, particularly when trading intraday or during Asian session hours.

The Bigger Picture: Why Indicators Must Work with Market Context

Source: Ainvest

No indicator offers a guaranteed signal. In 2025, more Indonesian traders are emphasizing context: news events, central bank statements, and geopolitical developments must be read alongside technical indicators. A perfect MACD-RSI alignment might still fail if released data contradicts the market’s expectations. That’s why experienced traders in Indonesia now combine technical signals with awareness of economic calendars, sentiment shifts, and liquidity flows — making MACD and RSI part of a bigger, smarter decision-making system.

Looking Ahead: MACD RSI Strategies Will Stay Relevant for Indonesian Forex Traders

The increasing accessibility of trading platforms and educational tools in Indonesia has democratized technical analysis. Among the many tools available, MACD RSI for Forex Indonesia continues to be among the most trusted. It’s not just about following indicators — it’s about how they’re used together, in the right context, at the right time. As 2025 progresses, MACD and RSI will remain integral to the trading playbook of Indonesians looking to balance strategy, discipline, and adaptability in an unpredictable forex environment.