The Secret Behind Prorex PAMM That Wall Street Doesn’t Want You to Know

March 3, 2025

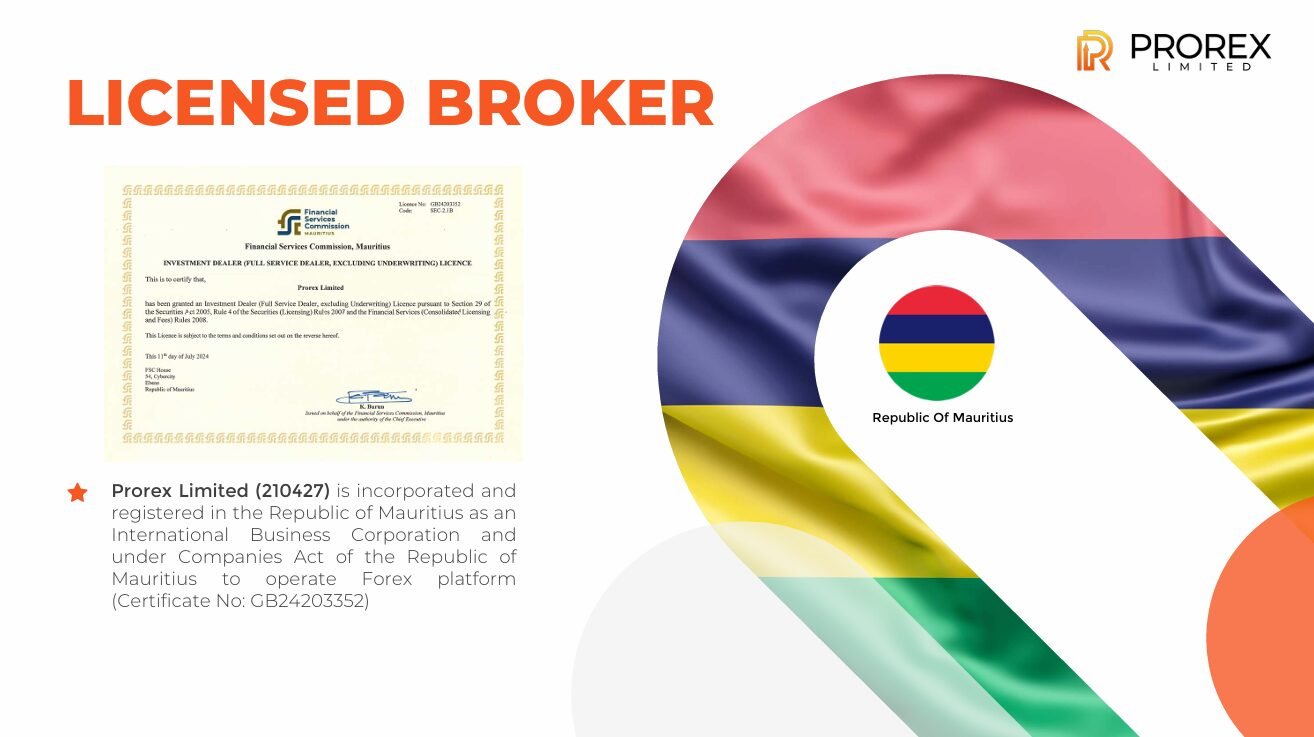

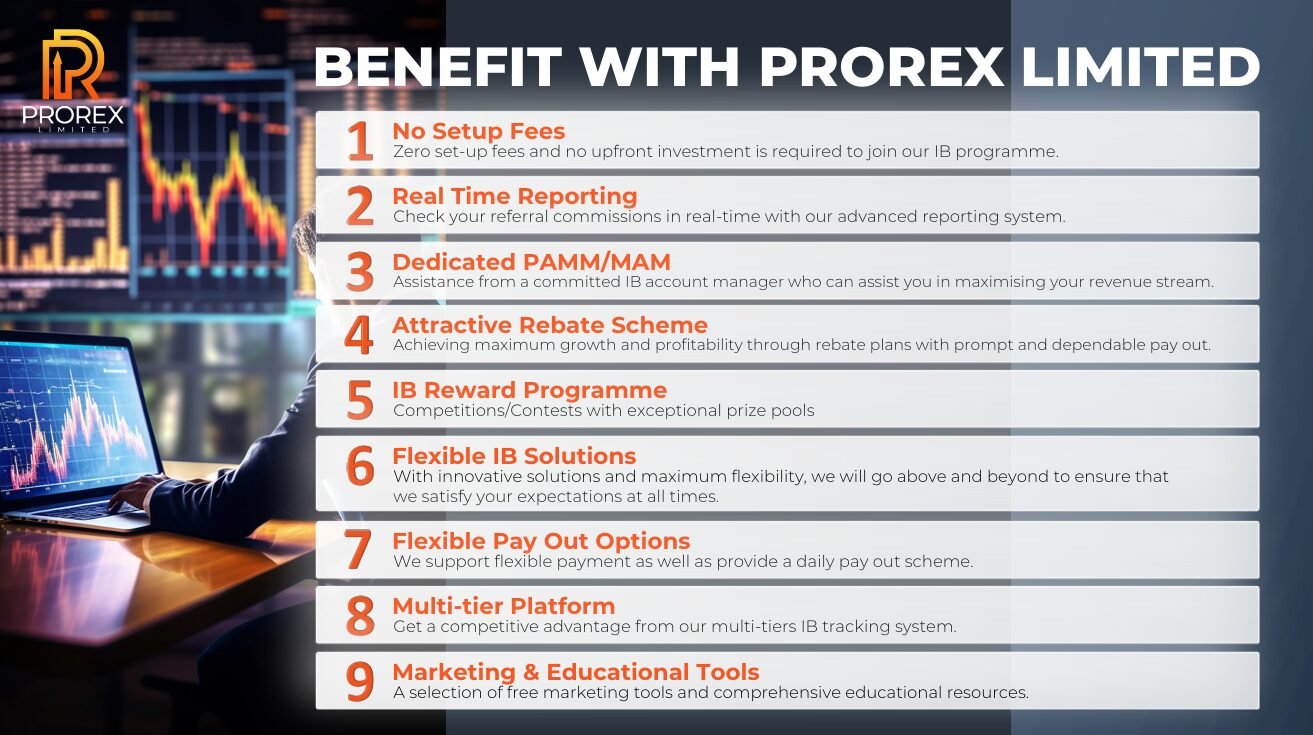

In the fast-changing world of online trading, one recurring issue for investors is the struggle to balance control with professional expertise. Many worry about hidden costs, lack of transparency, or strategies that don’t align with their goals. This is where Prorex Pamm enters the discussion, offering a system designed to solve these concerns through structured, transparent, and adaptable portfolio management.

The Problem of Prorex PAMM Transparency vs. Control

For years, one of the main barriers to managed accounts has been the fear of losing control. Investors hesitate to trust fund managers because they assume oversight will be minimal once their money is allocated. The solution, however, can be seen in how Prorex Pamm trading operates.

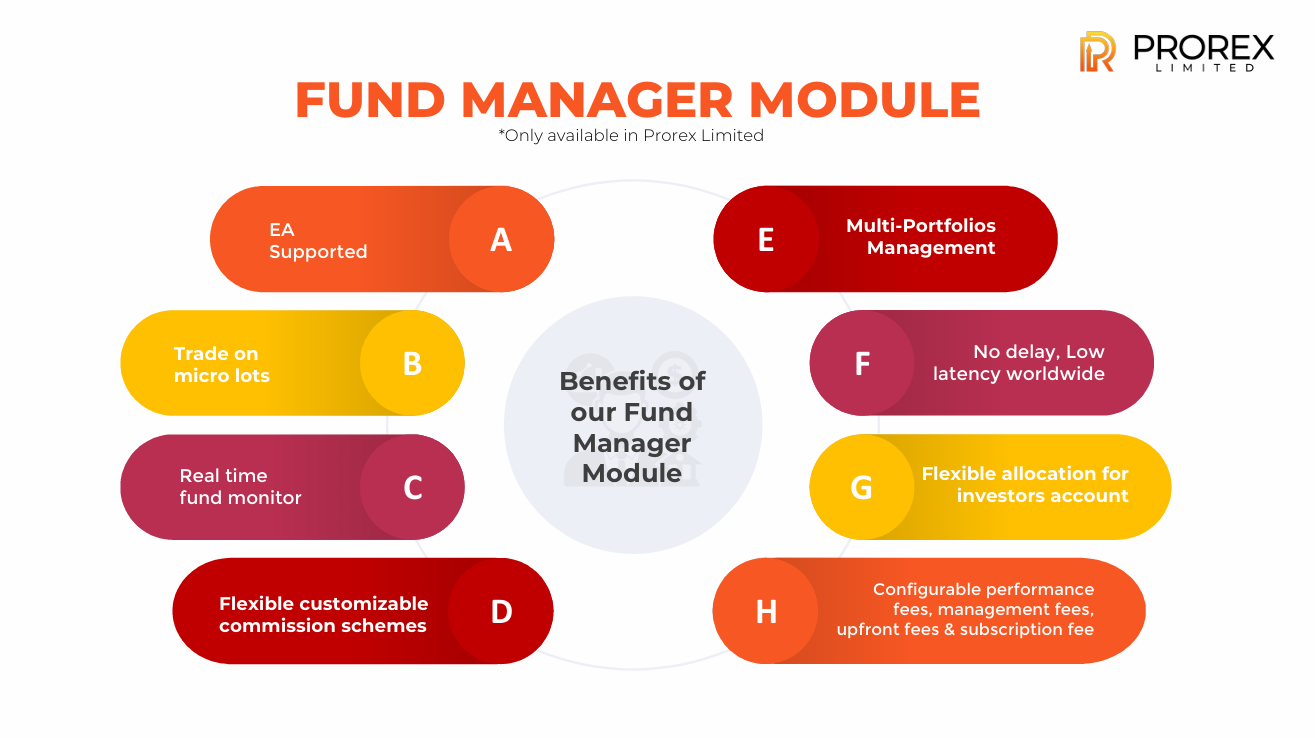

The platform ensures real-time visibility of performance, customizable allocation methods, and even configurable fee structures. By supporting Prorex indicators, Expert Advisors (EA), and Prorex AI trading, investors don’t lose control—they gain more tools to monitor and refine their decisions. With Prorex low spread conditions and clear terms on deposits, the system addresses the transparency challenge while giving users genuine autonomy.

The Problem of Passive Investing Misconceptions

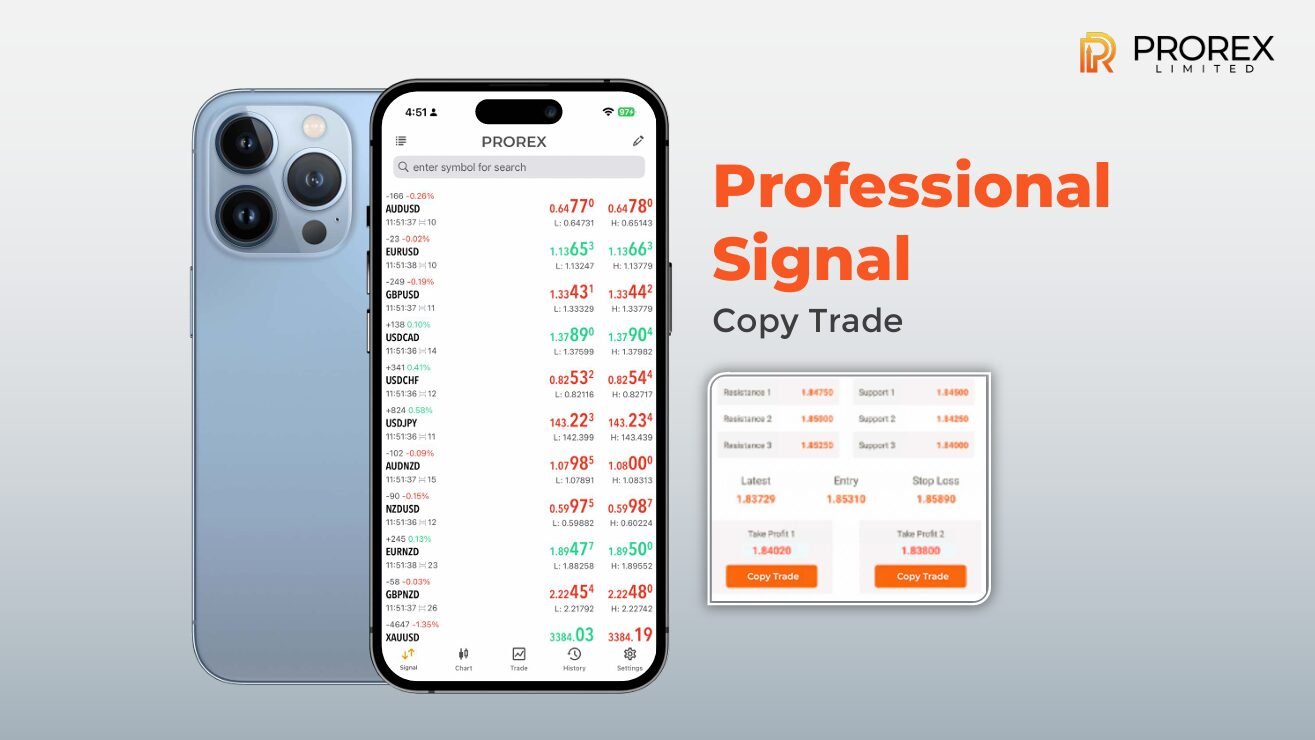

Another issue often faced in this space is the perception that copy trading platforms are nothing more than passive gambling. Critics argue that following another trader blindly can be risky. Prorex takes a different approach. Through Prorex copy trading, investors are provided with detailed data on strategies, past performance, and risk levels, allowing them to make informed decisions before choosing who to follow.

This transforms copy trading from guesswork into structured diversification. At the same time, traders who share their strategies benefit from the Prorex revenue share program, creating a balanced ecosystem. Incentives like Prorex free credit and Prorex free bonus also help new investors explore the system with lower risk, showing that the model isn’t about passive reliance but about informed participation.

The Problem of Outdated Fund Management Models

A final challenge is the belief that PAMM and MAM systems no longer fit the needs of modern investors. The reality is that outdated models struggle, but the Prorex PAMM system and its multi account manager (MAM) module offer a very different picture. By allowing managers to oversee multiple portfolios, adjust trading conditions, and set tailored performance fees. Prorex shows that managed accounts can evolve with the times.

Global low-latency execution, support for micro lots, and flexible portfolio structures. Position the platform among discussions of the best PAMM broker 2025. Instead of being obsolete, the Prorex PAMM account is a forward-looking solution that adapts to new trading demands while maintaining professional standards.

Conclusion: Prorex PAMM as a Practical Solution

When investors look at managed accounts, the problems they fear often revolve around transparency, control, and outdated structures. Examining the Prorex Pamm case shows how these issues can be solved through a blend of technology and trust. With features like flexible allocation, real-time monitoring, and seamless integration of copy trading and MAM tools. Prorex highlights how managed trading can be both transparent and adaptable. For investors and traders alike, it represents not just a solution but a roadmap to a more balanced trading experience.

【 Prorex Limited 】

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia