Prorex Pamm Trader Is Changing How Investors Sleep at Night

February 7, 2025

In today’s unpredictable financial markets, investors are constantly searching for ways to manage risk while still growing their capital. This is where Prorex Pamm Trader comes into the picture. Designed to bridge the gap between self-directed trading and professional fund management, the PAMM framework offers a practical solution for those who want access to expert strategies without the burden of monitoring every price movement on their own.

The Problem of Managing Trading Risk Alone

For many retail investors, one of the biggest hurdles in forex trading is handling volatility. Sudden market swings, the need for constant analysis, and emotional decision-making can often lead to losses. Even with tools like MetaTrader 5 or custom indicators, it can be overwhelming to stay on top of global markets while maintaining discipline. This is especially true for beginners who are drawn by the potential of passive income but lack the experience to sustain it.

The Solution: Transparency and Structure with Prorex Pamm Trader

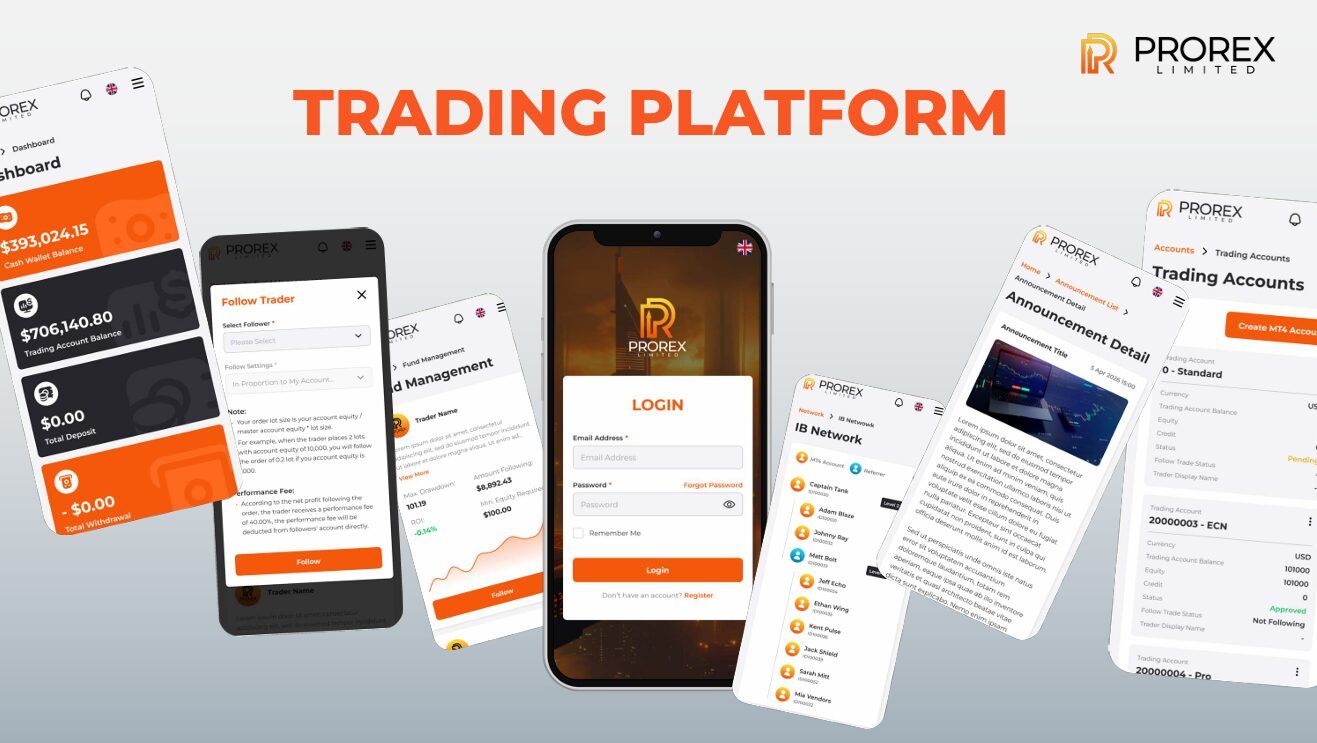

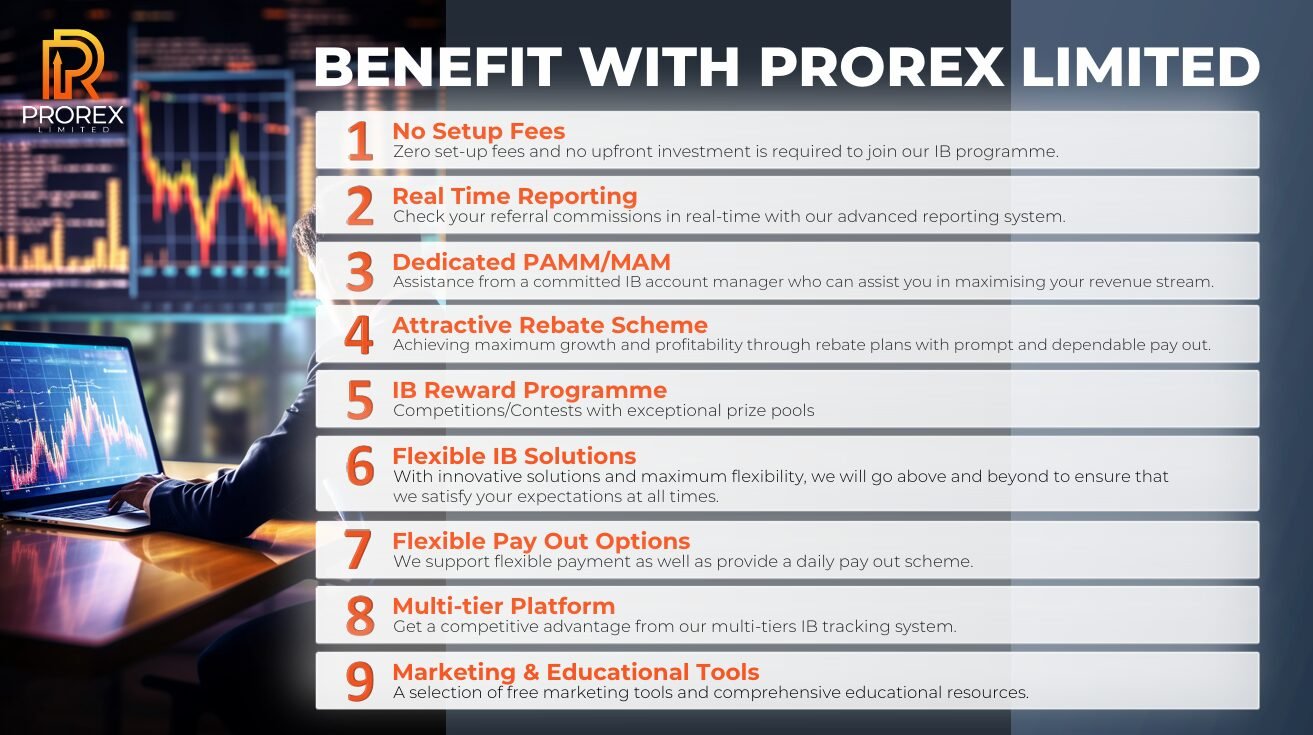

The Prorex Pamm Trader system addresses these challenges by introducing a structured model where funds are allocated to experienced managers. Rather than every investor opening and closing trades individually, capital is pooled and distributed proportionally. Prorex adds value by making this process highly transparent—performance fees, management charges, and even subscription options are outlined upfront.

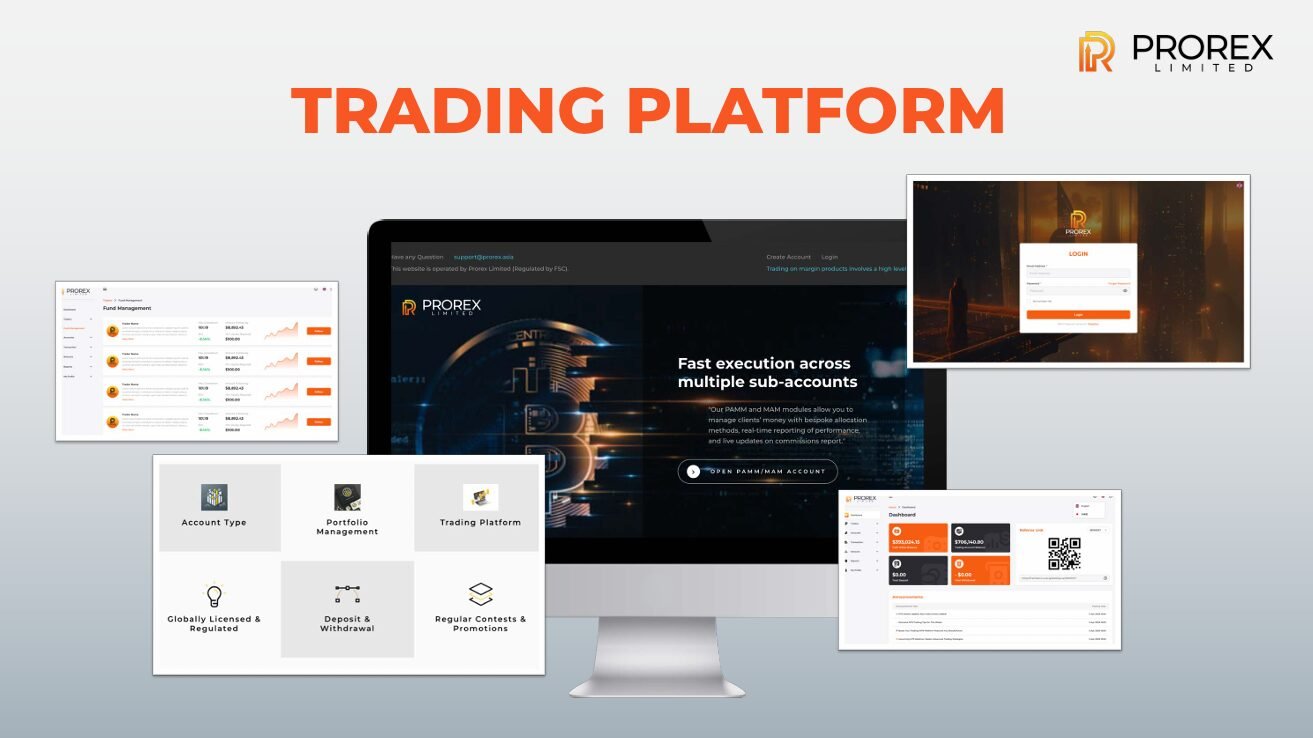

On top of that, Prorex operates under regulatory oversight in Mauritius and offers ultra-low spreads with lightning-fast execution speeds. Investors can monitor results in real time, diversify across multiple strategy providers, and decide allocations that match their own comfort levels. The use of MetaTrader 5 ensures efficiency, while compatibility with expert advisors (EAs) allows managers to integrate automated strategies seamlessly.

Beyond the Basics: Expanding Options for Investors

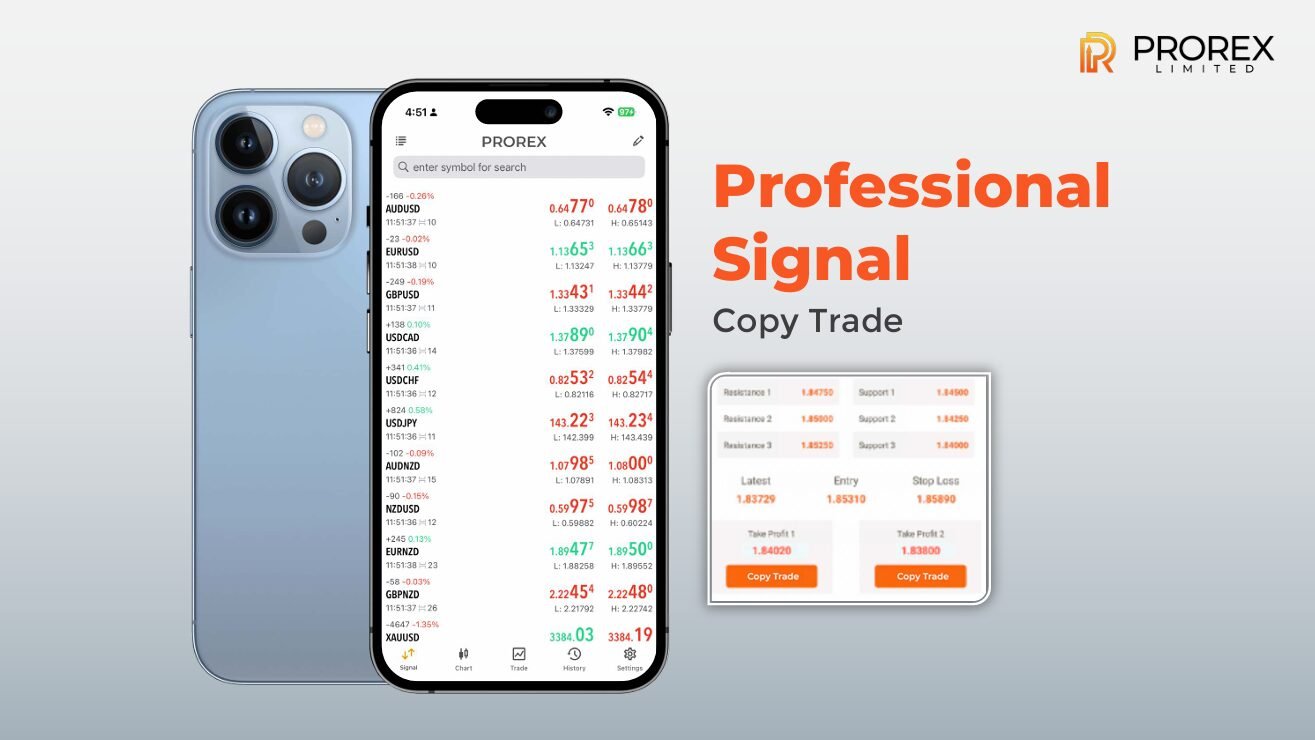

Another problem in traditional trading is the lack of flexibility. Some investors prefer direct trade mirroring through copy trading, while others want a more structured allocation model. Prorex resolves this by offering both options under one roof. Investors can choose between copy trading for one-to-one replication or PAMM accounts for pooled management with defined structures.

For strategy providers, the system also creates opportunities. They can design their own conditions, publish strategies with low entry deposits, and reach a wider client base through Prorex’s leaderboard feature. This dual ecosystem ensures that both professionals and everyday investors find value in the same platform—something many brokers struggle to balance.

Conclusion: Why Prorex Pamm Trader Fits Today’s Needs

In an environment where uncertainty is the norm, Prorex Pamm Trader provides a clear solution to common trading problems. It doesn’t promise risk-free results, but it creates a fair and transparent framework where investors can make informed choices and benefit from professional strategies. By combining regulatory oversight, advanced technology, and flexible investment options, Prorex positions itself as more than just a broker—it becomes a partner in navigating the complexities of forex investing.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia