Rupiah Forecast 2025: Between Stability Hopes and External Uncertainty

July 17, 2025

A Currency in Transition: Why 2025 Feels Different

The Rupiah Forecast 2025 arrives at a moment when global financial narratives are starting to shift — but haven’t yet settled. After several years of aggressive rate hikes, capital outflows, and unpredictable commodity cycles, emerging markets like Indonesia are watching for signs of normalization. The Rupiah has managed to hold relatively steady through this turbulence, but not without resistance. 2025 is unlikely to deliver a straight-line path for the currency. Instead, it will be a year shaped by transition — with investors balancing optimism about domestic growth against caution surrounding global monetary policy and shifting trade patterns.

The Dollar’s Grip Still Holds — But for How Long?

Source: Coincodex

A key tension behind the Rupiah forecast 2025 is the persistent strength of the U.S. dollar. Despite expectations of interest rate cuts from the Federal Reserve, inflation resilience and solid U.S. job data have kept the dollar from weakening meaningfully. This continues to put downward pressure on the IDR, which—like many emerging market currencies—is sensitive to dollar dominance. The longer the U.S. maintains high real yields, the harder it becomes for regional currencies to outperform. What investors will be looking for is a definitive pivot — not just signals — from the Fed. Until then, the Rupiah may struggle to gain firm ground.

Rupiah Forecast 2025: External Trade Patterns May Be Less Reliable This Year

Indonesia’s current account health has long been supported by strong exports of natural resources. But the IDR outlook in 2025 is clouded by mixed signals. Commodity prices have begun to level off, and global demand is shifting, particularly as China rebalances its economy. While Indonesia continues to benefit from diversification and downstream industrial policies, a sharp drop in global prices for coal, nickel, or palm oil would hit trade revenue. At the same time, rising import demand — especially for energy and capital goods — could narrow the trade surplus. The result is a more fragile external position, even if it’s not yet a cause for alarm.

Rupiah Forecast 2025: Domestic Economic Signals Offer Stability — If Maintained

Source: BPS- Statistic Indonesia

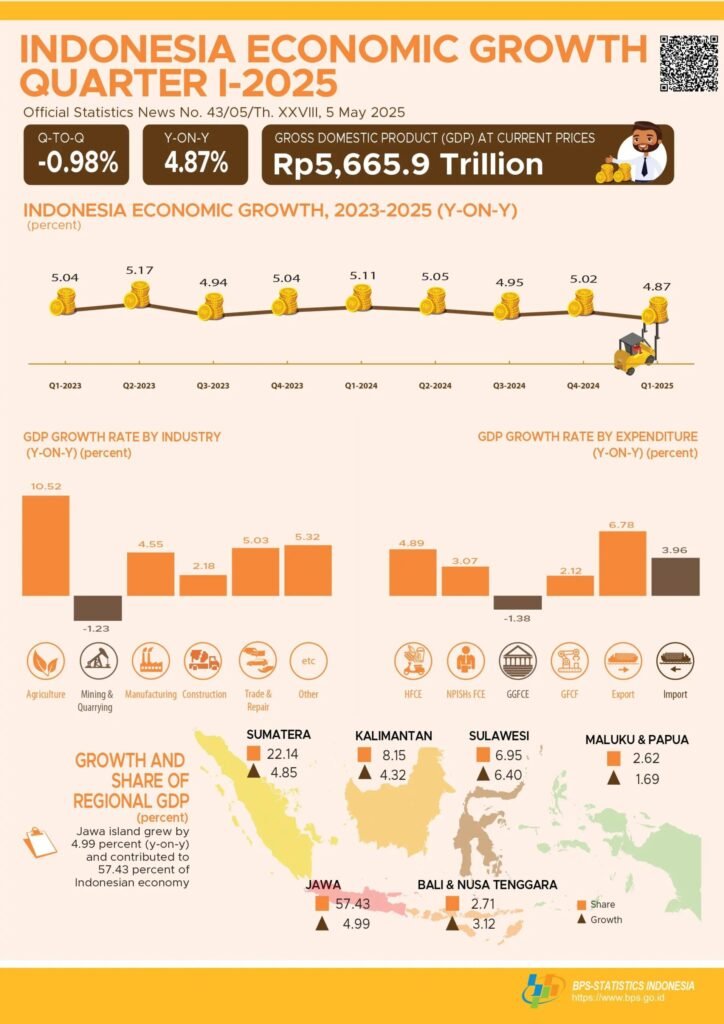

Internally, Indonesia is still sending the right signals. Forecasts suggest the economy will grow between 4.9% and 5.2% in 2025, backed by strong household spending and infrastructure activity. Inflation remains within Bank Indonesia’s target band, giving the central bank some breathing room. That said, the Rupiah forecast is vulnerable to shifts in sentiment — especially if fiscal pressures mount, or if government policy takes an unexpected turn in the wake of upcoming political changes. Markets are watching closely not just the data, but the tone of communication and consistency in implementation. Any wobble in confidence could trigger currency volatility, even without hard shocks.

Rupiah Forecast 2025: Bank Indonesia Remains the Anchoring Force

Source: IndonesiaWindow

Throughout past periods of volatility, Bank Indonesia has acted as a stabilizer — often intervening to smooth out sharp IDR movements. In 2025, its credibility will be as important as its tools. The bank is expected to remain cautious, with any rate adjustments likely to be measured and well-telegraphed. But its role extends beyond interest rates. Liquidity support, macroprudential tweaks, and timely market signaling all contribute to shaping the Rupiah outlook 2025. Investors, both domestic and foreign, are likely to continue rewarding consistency over aggressiveness. A steady hand remains the most valuable asset in an unpredictable global environment.

Investment Flows Are More Selective Than Ever

Source: NST.com

Another notable trend in 2025 is the increasingly selective nature of capital flows into emerging markets. While Indonesia remains attractive for long-term investment in energy, tech, and supply chain infrastructure, portfolio flows into bonds and equities are far more sensitive to global sentiment shifts. The IDR can benefit from temporary inflows, but it can also face abrupt pressure if investor risk appetite dries up. This dynamic puts more importance on maintaining investor trust through transparent regulation, currency management, and macro stability. In a year when markets are watching every signal, perception often moves ahead of fundamentals.

Relative Strength Is Not Absolute Protection

In the broader context of the emerging market currencies outlook 2025, the Rupiah sits in the middle: more stable than peers like the Turkish lira or Argentine peso, but not as insulated as the Singapore dollar or Chinese yuan. That positioning gives it some resilience, but also subjects it to broad EM selloffs. When investor sentiment shifts globally — often triggered by U.S. rate moves or geopolitical headlines — the IDR tends to follow regional flows, regardless of its own data. In 2025, this means that even a well-performing economy like Indonesia may still experience currency pressure through no direct fault of its own.

Final Outlook: A Year to Watch the Signals Closely

The Rupiah Forecast 2025 doesn’t point to crisis — but it doesn’t promise calm either. Instead, it suggests a year where the IDR will likely trade within a controlled range, nudged by external developments and underpinned by domestic resilience. For businesses, investors, and policymakers, the takeaway is not to bet on big swings, but to prepare for subtle shifts that reflect broader market changes. How Indonesia responds — with policy clarity, financial discipline, and investor engagement — will determine whether the Rupiah simply holds steady or slowly strengthens. It’s a year where reading the signals may be more important than reacting to the headlines.