Thailand’s Crypto Spending Shift: What 2025 Reveals About Real-World Adoption

March 27, 2025

Thailand’s Crypto Spending Shift: What 2025 Reveals About Real-World Adoption

Back in the early days, crypto in Thailand was all about trading—speculating on Bitcoin or flipping altcoins on local exchanges like Bitkub. Fast forward to 2025, and a subtle but meaningful shift is unfolding: crypto is moving offline. The digital coins once confined to exchanges and wallets are now entering beach bars, boutique spas, and Airbnb-style rentals.

This isn’t some sweeping revolution. It’s a trend defined by quiet growth—driven by a mix of foreign demand, regulatory gray zones, and evolving digital payment habits.

From Hype to Habit: The Transition Begins

Over the past few years, crypto adoption in Thailand has matured. No longer a novelty, digital assets like BTC and USDT are being integrated into real-world transactions—especially in cities with high foreign presence, such as Bangkok and Phuket.

Rather than being driven by top-down regulation, this change is largely organic. Business owners in tourist-heavy areas are experimenting with crypto payments, often under the radar. They’re motivated not by ideology, but by economics—crypto offers a workaround for transfer fees, banking delays, and exchange complications.

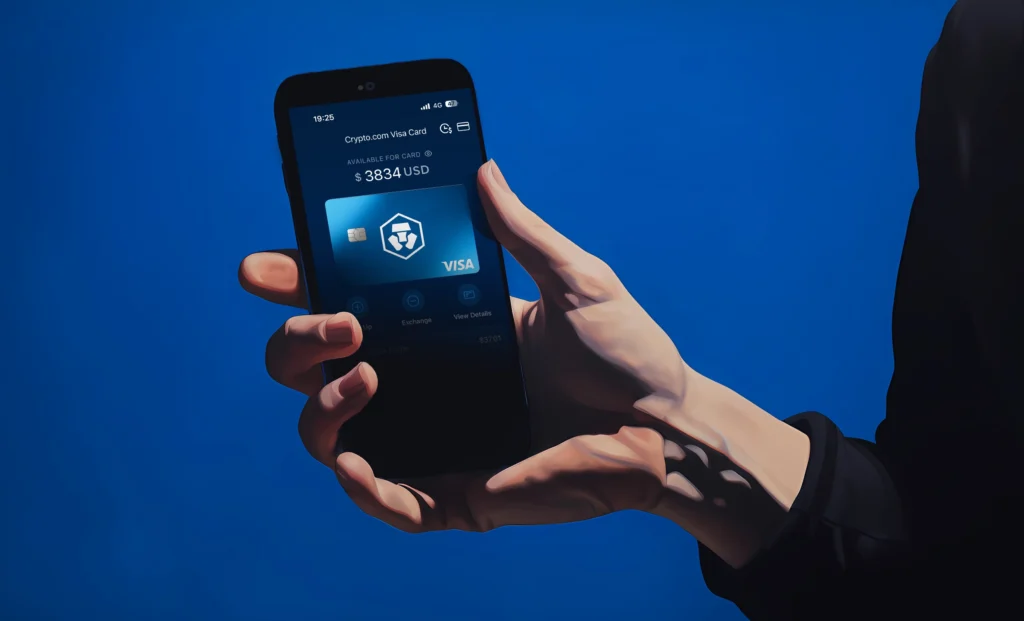

Credit from : Crypto.com

Where can I use crypto in Thailand: Bangkok’s Digital Payment Frontier

In Bangkok, the trend is visible in specific lifestyle sectors. Cafés in Sukhumvit, co-working spaces near Sathorn, and wellness studios catering to digital nomads have quietly introduced QR-code crypto payments. These businesses often partner with local platforms like Bitkub or integrate with processors such as Alchemy Pay.

It’s not widespread, but the consistency across certain districts suggests that crypto is being normalized—not in mass retail, but in niche, experience-driven markets.

Where can I use crypto in Thailand: Phuket’s Open-Minded Economy

Phuket, with its transient population and tourism-focused economy, is another key location where crypto spending is taking shape. Villa rentals and boutique hotels are testing crypto acceptance, particularly in stablecoins like USDT. Here, crypto acts as a frictionless payment alternative for international guests who don’t want to deal with currency exchange or wire transfers.

Local tour operators, wellness retreats, and even some nightlife venues have started accepting crypto on a case-by-case basis. The system is informal and often not advertised—but word spreads fast in Telegram groups and travel subreddits.

The Tech and Social Layer Driving Adoption

What’s interesting isn’t just the availability of crypto spending—it’s who’s doing it and why. The surge in digital nomads, Web3 workers, and crypto conference attendees has created pockets of early adoption. These users not only hold crypto, but expect to use it in daily life.

In a way, Thailand’s tourism economy has become a testing ground for practical crypto use. And while adoption is still uneven, the feedback loop between users and vendors is beginning to solidify.

Obstacles That Still Shape the Trend

Despite its momentum, crypto adoption in real-world Thai commerce still faces barriers. Volatility remains a concern for businesses, particularly with BTC. That’s why stablecoins like USDT are becoming the preferred medium for most retail-level crypto transactions.

On the regulatory side, Thailand’s framework is clearer when it comes to trading. Licensed platforms like Binance TH and Bitkub operate legally—but direct merchant transactions are in murkier territory. As a result, many vendors convert crypto to Thai baht immediately, using third-party processors to avoid risk.

Additionally, the general public remains cautious. Most Thai consumers and smaller merchants aren’t yet educated on wallet use or blockchain fees, limiting mass-scale retail adoption.

The Bigger Picture: A Test Case for Crypto Utility

What’s happening in Thailand might seem small-scale now, but it represents a meaningful test of crypto’s long-promised utility. The country’s unique mix of tech-savvy expats, open-minded tourism businesses, and evolving regulations has made it one of Asia’s quiet leaders in crypto-spending experimentation.

If the trend continues—and legal clarity improves—Thailand could become one of the first countries in the region where crypto moves beyond speculation into something more tangible: daily-use finance.