Could Prorex Copy Trading Be the Easiest Door Into Complex Markets?

April 20, 2025

In the dynamic world of online trading, many investors are drawn to the idea of mirroring experienced traders. Yet, copy trading often carries challenges: lack of transparency, limited control, and inconsistent performance reporting. Prorex Copy Trading enters this space as a case study in how these issues can be addressed. Offering traders and followers alike a framework built on clarity, low spreads, and adaptable technology.

The Problem of Limited Control in Prorex Copy Trading

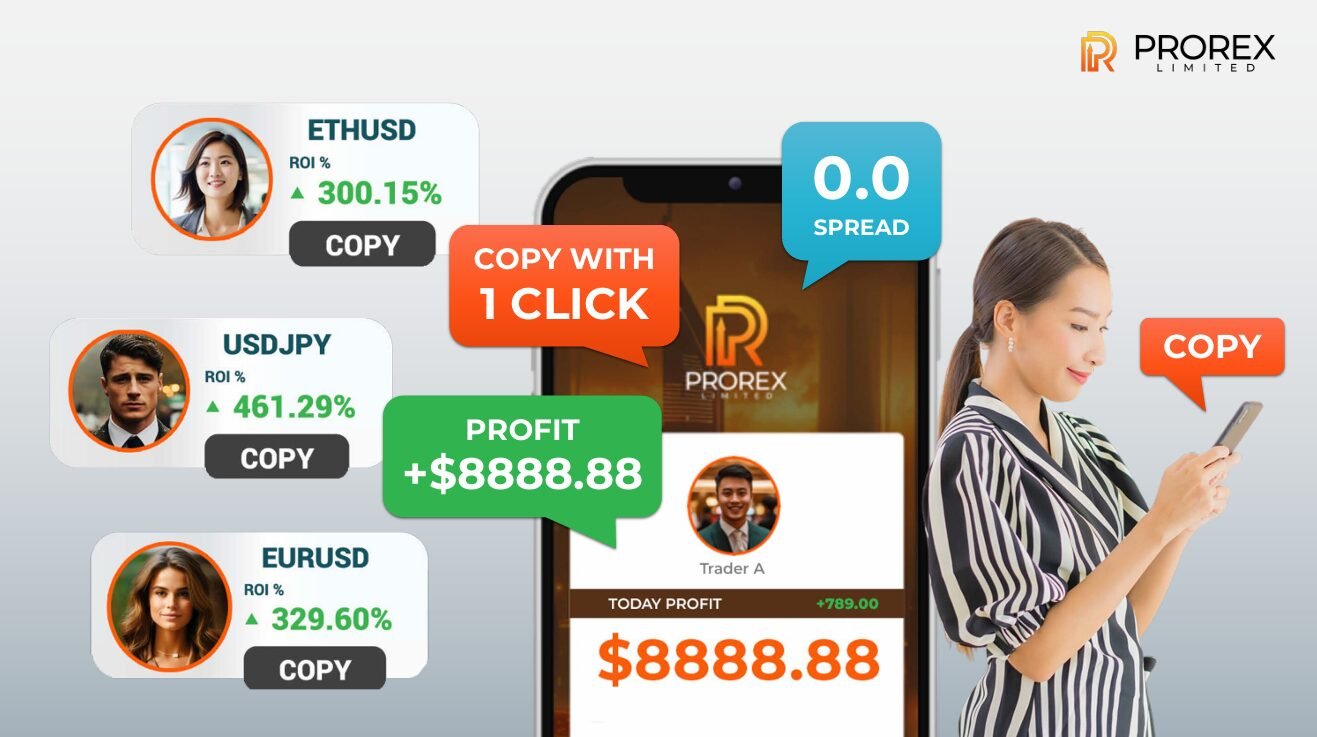

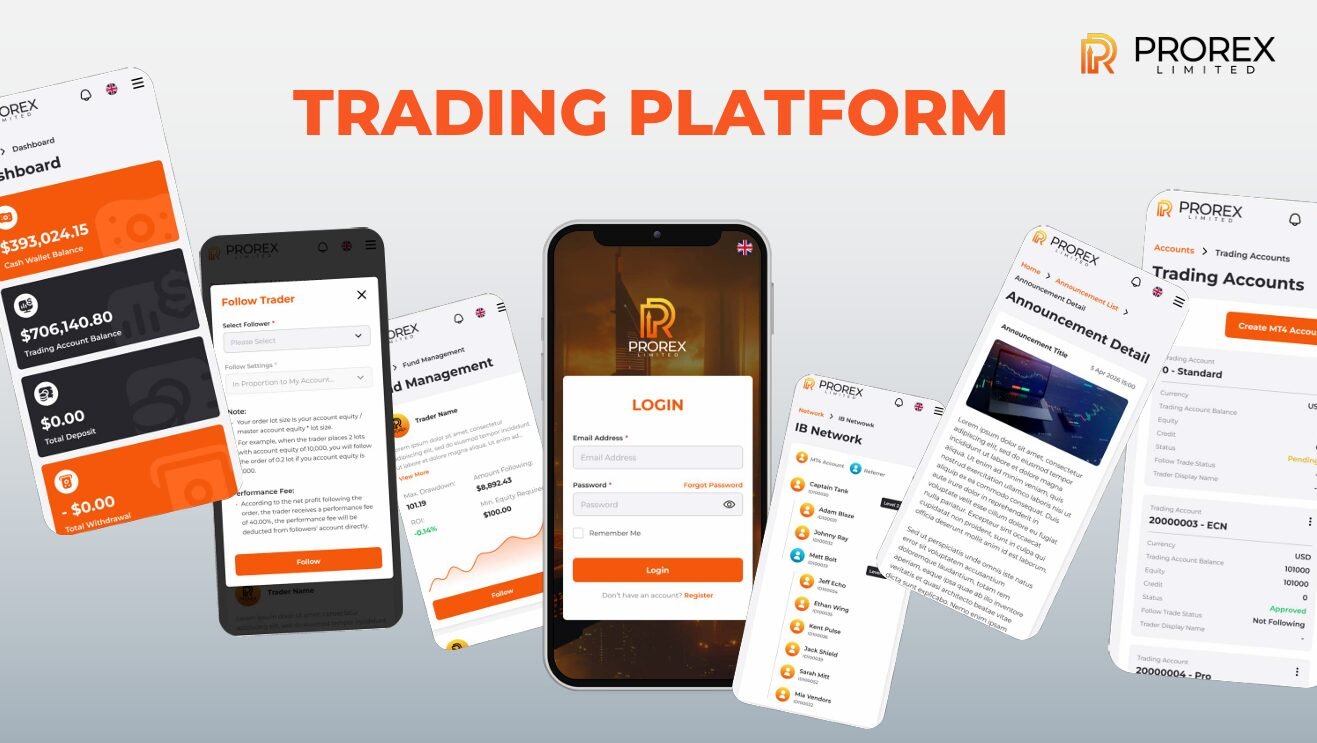

For newcomers, one of the biggest frustrations is the feeling of handing over full control when copying another trader. This often creates hesitation, as investors worry about blindly following without visibility. Prorex Copy Trading approaches this differently. Through its integration with MetaTrader 5, users can review strategies, study historical results, and track live performance. Followers are not locked out—they can choose traders, adjust allocations, and diversify across multiple strategies.

The inclusion of Prorex pamm trader and multi account manager trading modules further strengthens this sense of control. Providers can share their strategies with configurable fees and conditions, while followers gain transparency in how their funds are allocated. In short, the solution replaces passive following with interactive choice.

The Challenge of Accessibility for Prorex Copy Trading Beginners

Another obstacle in copy trading is accessibility. Many platforms set high entry barriers or cater exclusively to professionals, discouraging those who want to start small. Prorex Limited takes a different stance. With options like Prorex free credit, Prorex free bonus, and low minimum deposits, beginners can ease into the market without overcommitting. This creates a practical path for those seeking a beginner copy trading guide experience.

At the same time, professional traders are not left behind. Through the Prorex Revenue share program, competitive rebate schemes, and access to trading with low spreads, providers can scale their strategies and attract followers. This dual design ensures that both newcomers and seasoned experts find value on the same Prorex trading platform.

The Issue of Trust and Transparency

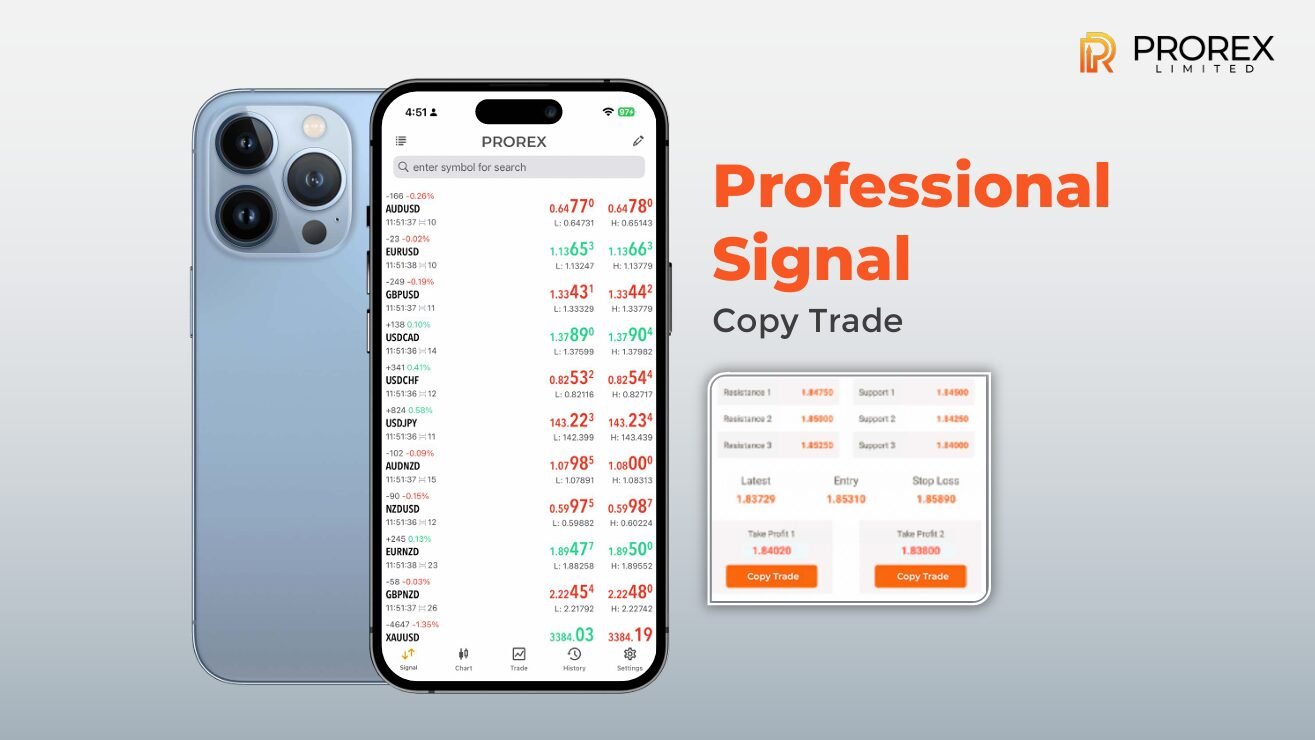

Perhaps the most pressing concern in copy trading is trust. Investors often worry about hidden fees, unclear reporting, or inflated claims. Prorex Copy Trading addresses this head-on with real-time reporting, customizable fee structures, and automated trading solutions that integrate seamlessly with MT5. The platform also supports Prorex ai trading and Prorex indicator tools, giving both providers and followers deeper insights into strategy performance.

These structural safeguards place Prorex among the best copy trading brokers and within the conversation about top copy trading apps 2025. The focus is not on promises but on building a system where results can be tracked, measured, and adapted—offering a tangible answer to the trust gap that has long challenged copy trading platforms.

Conclusion: From Problems to Practical Solutions

Copy trading has always carried both appeal and uncertainty. By studying the approach of Prorex Copy Trading, it becomes clear how problems such as lack of control, limited access, and weak transparency can be turned into strengths. Through PAMM/MAM modules, AI-driven tools, low spreads, and clear reporting, Prorex Limited has built an environment that balances opportunity with structure. For investors—whether beginners exploring copy trade strategies or professionals managing multiple accounts—this solution demonstrates how copy trading can evolve into a reliable and sustainable practice.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia